How Cryptocurrency Credit Card Actually Works

Let’s debunk what crypto credit cards actually are and how they work

In spite of popular belief, the so-called crypto credit cards that you get from traditional banks are not true cryptocurrency cards because they don’t allow you to spend in crypto. You actually transact in fiat currencies such as USD, GBP, EUR or JYP. The only crypto thing you get is in the rewards or cashback. So, instead of earning loyalty points or cash in return, you receive Bitcoin or Ethereum tokens instead. That’s it!

A real crypto credit card, instead, enables you to spend directly in cryptocurrency be it BTC, ETH or even stablecoins like USDT. These cards, such as those from CryptCard, enable you to transact in specific cryptocurrency for each card.

Let’s learn to draw the line between a real cryptocurrency credit card and a reward-based crypto card.

Your blockchain wallet is your credit card

A credit card that gives you points in crypto still works and behaves like a standard credit card. This means you still have a credit card number with your name and expiry date attached to it.

Because a genuine crypto card enables you to spend directly in cryptocurrency, you use your crypto wallet as your card. This also means your wallet address is your credit card number.

For instance, if you own the widely-used MetaMask wallet, you can use your wallet address to apply for a crypto card.

No magnetic strip or chip, just your secure blockchain wallet

You use an ordinary credit card by swiping the magnetic stripe, inserting the chip or entering your card information in an online store.

But since a crypto card sits in your blockchain wallet, you use your card like how you use your wallet to sign a message.

Again using MetaMask as an example, you essentially “swipe” a transaction by creating a digital signature.

But you might think, what about gas fees? Well, you don’t actually have to pay for gas when signing a message using your crypto wallet. The video below demonstrates how you can make an online purchase using a USDT credit card without paying for gas.

How signing a message differs from swiping

Each time when you swipe a physical credit card using the chip or magnetic stripe, the credit card reader actually reads the same information that is available on your card – your name, card number, expiry date and CVC/CVV number. It is essentially the same as you entering the same details on an e-commerce website when making an online purchase. This means your merchant could potentially see the entire details of your card and could easily forge your card.

But when you sign a message with a crypto wallet, you are basically encrypting a text message – usually containing the details of your transaction – with your wallet’s private key. You don’t even need to share your sensitive data like your card details, your name, and address like we so often do when shopping online with traditional credit cards. This signature could then be verified by the crypto credit card network to ensure its authenticity.

And since you are not sharing your private key (essentially your wallet’s password) with the merchant or the card processing network, no one can counterfeit your card. How’s that for card fraud or even identity fraud prevention?!

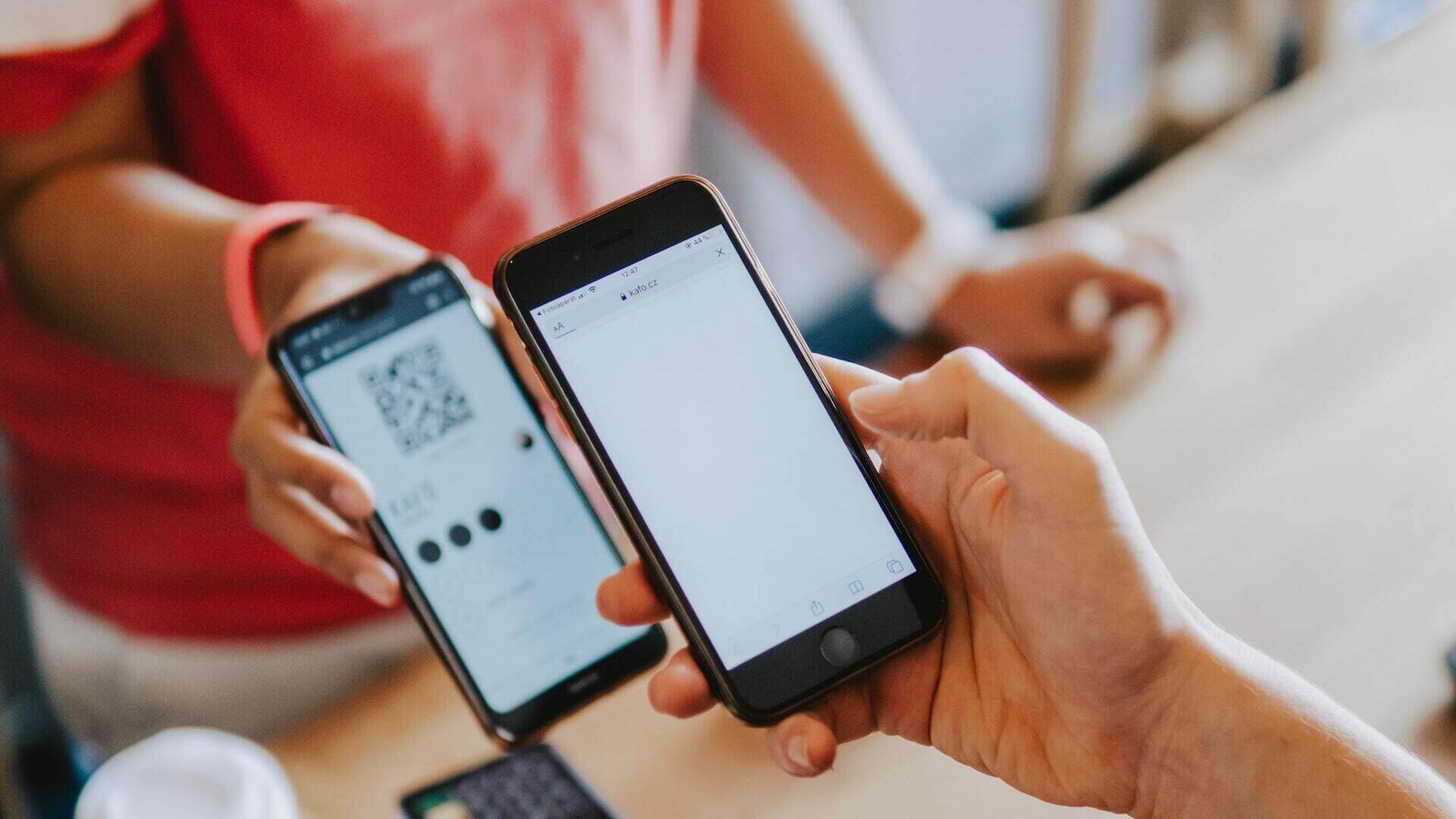

However, the usage behavior when using your crypto card at an offline establishment is a bit different. You’d need a mobile wallet installed on your smartphone and you need to scan the merchant’s QR code when you pay. The video below explains it all.

How crypto credit cards and normal cards are alike

Both are still credit cards that allow you to spend now and pay later. You will still receive your credit card bill each month and you still have to pay the amount you owe.

But with the crypto option, you have to settle your bills in crypto – the same cryptocurrency that you spent in. So, if you own a USDT credit card, you will spend in USDT and pay your card statements in USDT too.

So, should you get a crypto credit card?

The cryptocurrency market is constantly evolving to perpetually better itself. If you believe in the spirit of constant improvement, including improving your financial livelihood, then you should apply for a crypto credit card now and experience it yourself. Don’t be surprised if you get a way better deal than from your banks. As the saying goes, or at least our saying, fortune favors the intellect.