Similarities Between Central Bank and DeFi in Interest Rates, Quantitative Easing and Inflation

DeFi and traditional finance aren’t that different after all.

It was during the 2008/9 Great Recession that marked the birth of cryptocurrency where Bitcoin raised from the ashes and eventually path the road to decentralized finance – what we call DeFi today.

The famous Genesis Block in Bitcoin blockchain contains this very phrase – “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

As much as the DeFi community is trying to detach itself from the traditional finance sector that caused the recession, there are many similarities in how both operate. Let’s examine how these two finance spectrums continue to make the world go round.

Interest Rates

Central banks like the US Federal Reserve (aka the Fed) use interest rate to manage the economy by controlling the supply of money. This rate acts as a double edge sword where at one edge, it reflects the amount of interest a central bank and its network of banks earn when lending out money. On the borrower’s side, it’s the amount they have to pay when borrowing money from banks.

A low-interest rate encourages people to borrow money which puts more supply of currency into the market while a high-interest rate discourages borrowers hence reducing the supply.

The same is happening in DeFi. Lending and borrowing still happen except it’s not centralized to central banks and their associated banks who all work together to control a nation’s economy.

There’re various projects that lend out money to borrowers. We do not label them as companies because that term is generally used for profit-making entities. In DeFi, they are called protocols. So, a website that offers loans in the form of cryptocurrencies (aka tokens) is called a lending protocol.

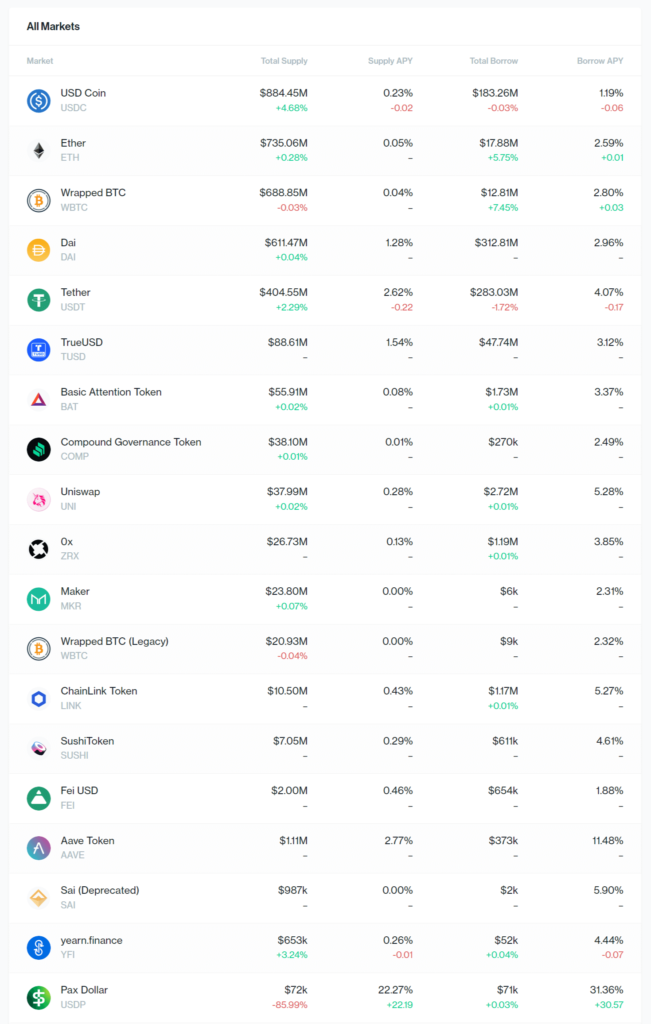

These projects or decentralized lending applications accept cryptos from crypto holders to lend them to borrowers who usually use them to fund their crypto trading activities. These funds are deposited into liquidity pools where each pool consists of one type of token. It can be any type of cryptos such as Bitcoin, Ethereum, stablecoins and non-stable ones too. Each pool has an interest rate set so that borrowers are charged with this rate which becomes the lenders’ earnings.

Now, think of each liquidity pool as a country’s economy. To control the amount of tokens being lent out, the interest rate is adjusted. So, just like what a central bank does, if they want to encourage people to borrow money, the lending software program (aka smart contract) reduces the interest rate of a pool so that more people will borrow. If they have too many borrowers and this is depleting the crypto supply, the interest rate is increased. This also encourages lenders to add more tokens into the pool since they can earn more from the higher interest rate but incentivizes borrowers to return their borrowed tokens since it has become more expensive to borrow. The net result is the controlled supply of tokens.

Do note that there’re many decentralized projects using the same lending and borrowing mechanics with the same cryptos, unlike the central bank scenario. Hence, the word decentralized.

Quantitative Easing

We all know that central banks have the license to print fiat money. Similar is true on DeFi land. Again, imagine there’re many central banks instead of just one in DeFi. In fact, due to lack of regulation, anyone can be a central bank without needing any license. Well, sort of.

Each cryptocurrency is like a fiat currency, except that it is digital. By the way, there’s no such thing as physical cryptocurrency made out of paper and metal.

You may choose to create your own cryptocurrency and call it <YOUNAME>COIN. All you need to do is write a programming code to create a smart contract (there’re free templates available) on software like Remix, compile the code and upload this contract on a blockchain like Ethereum. The only cost you have to bear is the gas fee which is paid using Ethereum tokens, abbreviated to the symbol ETH.

You may “print” as much supply as you want by entering the digits in your token minting smart contract. But, similar to fiat money, it is not pegged to any real asset. While the value of a fiat currency is influenced by a nation’s economy, the value of crypto is usually fixed to the value of the ecosystem that uses it as a medium of exchange.

You could in fact create a mini economy out of the newly minted crypto you just created. As long as there’s a demand and supply for your token, it should have intrinsic value just like any other fiat currency.

For example, if you own a mega-franchise network, you could decide to convert your existing loyalty points system into a system based on cryptocurrency. This loyalty crypto can be traded publicly on a crypto exchange such as Binance or Coinbase which allows the exchange of fiat with your crypto. Or you could get it traded with other cryptocurrencies on a decentralized exchange like SushiSwap or Uniswap.

This availability of conversion will impart value on your crypto. This is exactly how Bitcoin got its initial one-dollar value when someone agrees to exchange it for a US one-dollar bill. Now, any of your loyal customers who own your points could convert theirs into your tokens. Anyone could also buy your tokens with dollars or swap them from other tokens like Bitcoin or Ether. Since you’re the supplier of this token, you earn from seigniorage.

Your token holders could now exchange for merchandise with this crypto or earn more of them by spending cash at your stores. Once your crypto sufficiently acts as a medium of exchange and carries a value, you’ll have sovereignty over it since you’re the creator and is able to control its supply. This leads us to the next topic.

Inflation

The definition of inflation is rather vague because it can come in different facets. In general, inflation is defined as the general increase in the prices of goods and services or the contraction of purchasing power but both actually mean the same thing. This is what generally happens in the U.S while the US dollar remains strong as ever.

However, inflation could also mean the reduction of value in a currency. For instance, the Zimbabwe dollar lost 98% of its value on a daily basis during mid of November 2008. The same goes to the Venezuelan bolívar during its hyperinflation crisis. These fiat currencies dramatically lost their value due to overprinting and the decline of their respective economy.

The DEFi community subscribes to the notion that the declining value of cryptocurrency is dubbed inflation. This is the very way how Bitcoin was invented, to fight debasement – the act of printing more money. Bitcoin was designed with the goal of “printing” only to the maximum of 21 million tokens.

However, most other cryptocurrencies do not adhere to this and were created to be inflationary which means the token creator could mint more without a ceiling limit, thus, resembling today’s fiat currencies.

Looking back at traditional finance, central banks’ aim is to set a country’s inflation rate at a nominal value each year. The Fed prefers an inflation rate of 2% or under, referring to the rise of prices and not the devaluing of its currency. They generally do this by increasing or lowering interest rates which in effect also control the supply of money in circulation. When things are hot and inflation is high, they increase the rate. The opposite is true when consumer spending is low and prices of goods and services are declining.

Hitting the ideal inflation rate is one of the missions of central banks. What about in DeFi?

The cryptocurrency community should be ecstatic to have such inflation problem. What this means is too many people are using their tokens to spend which causes prices to rise against the token value.

At this moment, the cryptocurrency market is still relatively young and has yet to go mainstream. Most blockchain providers and crypto issuers are trying to bridge this gap but it takes time. Bitcoin was invented in 2009 but the market only took notice in 2014.

At the moment, the total value of specific crypto is measured by its market capitalization. Bitcoin, for instance, currently has a market cap of around $400 billion dollars in value. But majority of Bitcoin owners are HODLers (as in holders) who hold on to this precious digital asset hoping the price will continue to rise. Which actually defeats its original purpose of becoming a medium of exchange. Some are reluctant to even spend a fraction of it fearing the price might just increase the next day.

This actually feeds into the volatility of crypto price because it prevents mass-market adoption which could stabilize its value if a sufficient amount of it is in the hands of many across the world. This stable value can be further reinforced if crypto is used widely as a medium of exchange which will create an equilibrium in its supply and demand.

Thus, we have yet to really see a cryptocurrency token that suffers from significant inflation like in the US but hopefully, these days are numbered.