The Many Use Cases of Wrapped Tokens Like WBTC and WETH

Learn by example why wrapped tokens were invented.

WBTC, WETH and many other wrapped tokens are intriguing, to say the least. If you have been reading about it online, you’d probably get the idea of what they are and why we need them.

Here’s a quick recap.

“Wrapped tokens are used to bridge between different blockchains like Bitcoin with Ethereum - BTC and WBTC”

“They are also used to allow smart contract to accept compatible tokens. Like converting ETH - a non ERC-20 compatible token to WETH, an ERC-20 token.”

But let’s dig deeper to learn how they are actually used.

Mining Pools

One of the many good use cases of WETH, a wrapped version of ETH is in mining pools. We all hate the exorbitant gas prices we have to pay on Ethereum. So, imagine if you’re mining for ETH. The amount of work and cost involved are already extreme let alone transferring out the ETH once you mined them. The gas fee will surely eat into your profit.

Therefore, some mining pools are actually paying out in WETH instead of ETH. By using a separate L2 layer network like Polygon.

So, instead of doing payouts in ETH on Ethereum, the pool pays you in WETH on Polygon network while absorbing the cost of gas which is negligible compared to gas on Ethereum. As WETH on Polygon is pegged to ETH on a one-to-one basis, you are actually getting ETH value in return. All you have to do is swap your WETH on Polygon at the bridge to actual ETH on Ethereum and voila, completo!

Centralized and Decentralized Lending

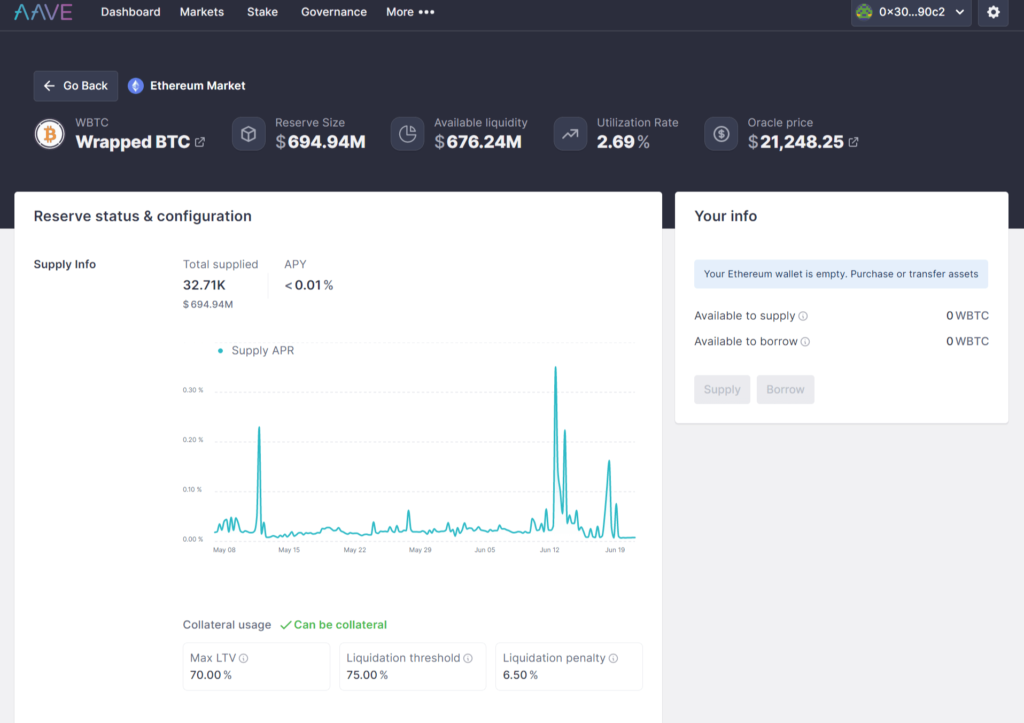

Let’s examine a use case for WBTC. Say you own lots of BTC and you want to lend them out to gain interest. Since Bitcoin doesn’t have smart contract capability, most lending protocols use Etherum network instead. It’s also obvious that you cannot send your BTC to Ethereum chain cos they are not compatible to one another. But what you can do is bridge your BTC to WBTC on Ethereum and deposit your newly owned wBTC on lending protocols like Celsius (centralized) or Aave (decentralized). Both of these protocols run on Ethereum, not Bitcoin.

Borrowers on those protocols could borrow these wrapped BTC from the specific lending pools which now have some of your WBTC tokens. They could use it to say earn from arbitrage on exchanges (buy WBTC from one exchange and sell on another while pocketing the difference in the price) or borrow using flash loans on Aave. Here’s a practical guide to how flash loans work.

Decentralized Exchange (DEX)

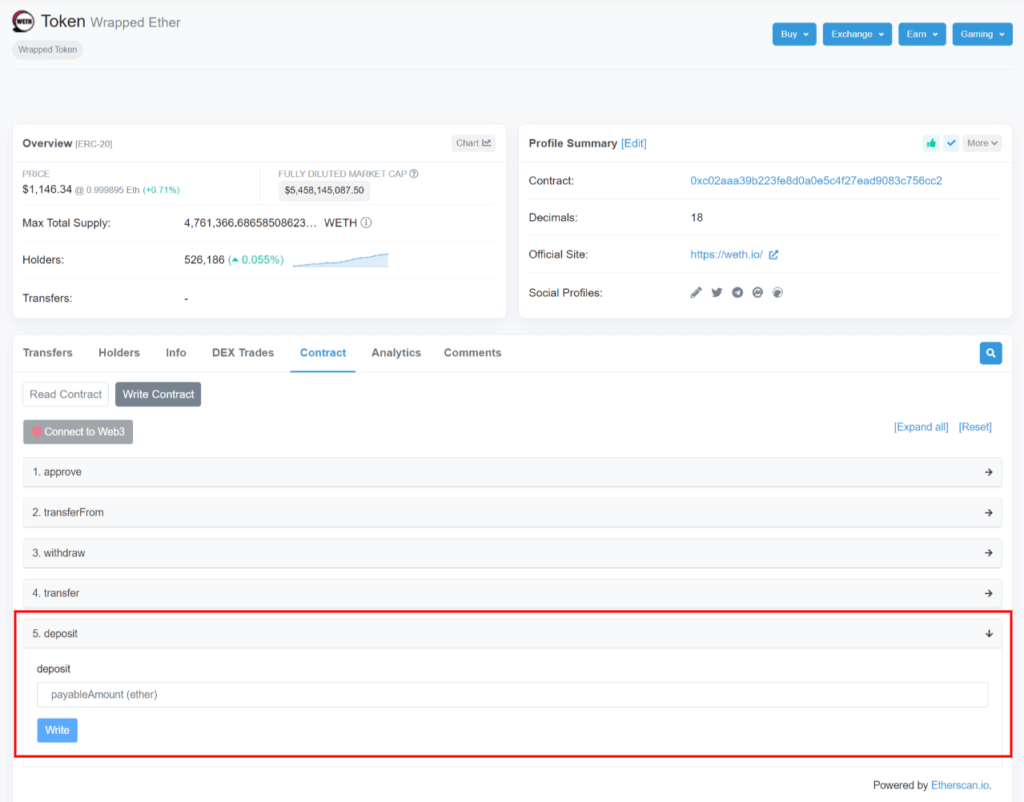

A DEX is managed independently on smart contracts. So, imagine you’re on Uniswap, one of the most popular decentralized exchanges, and you wish to swap from ETH to LINK because you need to use Chainlink oracle service.

When you convert your ETH tokens, they actually get wrapped into WETH (the ERC-20 version of ETH) prior to being sent to the swapping smart contract. This is done via the deposit function in the WETH contract. The WETH tokens are then converted into LINK ERC-20 tokens.

This deposit function is not actually part of the ERC-20 token standard but as long as the token adheres to its minimum standard of having specific functions like totalSupply, approve, transferFrom, etc, it’s fine.

NFT Auctions

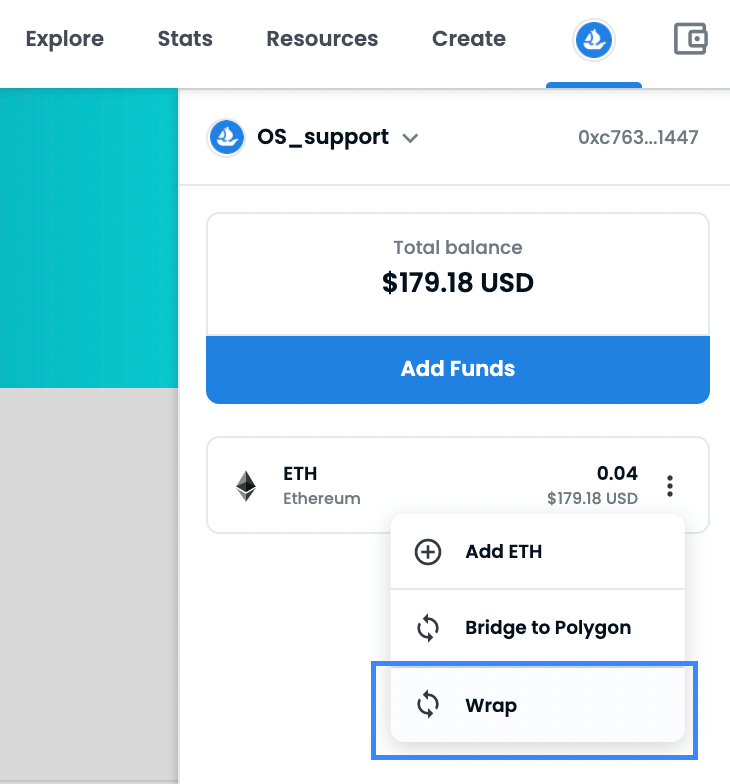

OpenSea is known for requiring you to convert your ETH to WETH when you wish to bid on NFT auctions on their marketplace. Why so?

It’s to allow you to bid on auctions without actually spending your cryptos. This means if you bid on an auction and when you win or the seller accepts your bid, your WETH gets spent, otherwise, it will be returned to you. In order to program that logic, OpenSea relies on (you guessed it) smart contract. From what we have learned, smart contract only accepts ERC-20 token thus WETH is required.

Without smart contracts, you could imagine the gas cost and hassle of running an auction. You have to send your ETH to OpenSea’s auction wallet and if you lose the bid they have to refund you the ETH. That’s two transfers each tied to a gas fee. Now, multiply that with the thousands of transactions for all the auctions with all the bidders!

Thank God for wrapped tokens and smart contracts.

Port Your Dapp to an EVM Blockchain Using Wrapped ERC-20 Token

The third example covers the use of wrapped ERC-20 token. There’s a long list of EVM (Ethereum Virtual Machine) compatible blockchains that work the same way as Ethereum network except they are not. They are like copies of Ethereum without the expensive gas fees.

If you’re a dapp developer who issue your own ERC-20 tokens, you could consider sparing your users from paying crazy gas fees by allowing them to use an alternative EVM chain that works with your dapp. To do this, you need to create a wrapped version of your token on the new EVM chain.

To facilitate this conversion, the blockchain protocol should provide you a bridging dapp that enables you to create a wrapped version of your token for their chain. For example, Polygon network has a bridge dapp that lets you do this. So does Metis and Aurora/NEAR protocol. But please note that not all chains are willing to accept your wrapped tokens on their platform. Avalanche, for instance, has not open up their bridging facility to every token issuer. Below explains why.