Why Crypto Credit Cards are 4 Times More Secure Than Standard Credit Cards

Cryptocurrency credit cards could prevent payment and identify fraud at once

There’s no doubt that cryptocurrency has taken the financial world by surprise. And as a result, we have started to witness the emergence of innovative financial products such as crypto credit cards, which enable users to spend their virtual currency in the real world.

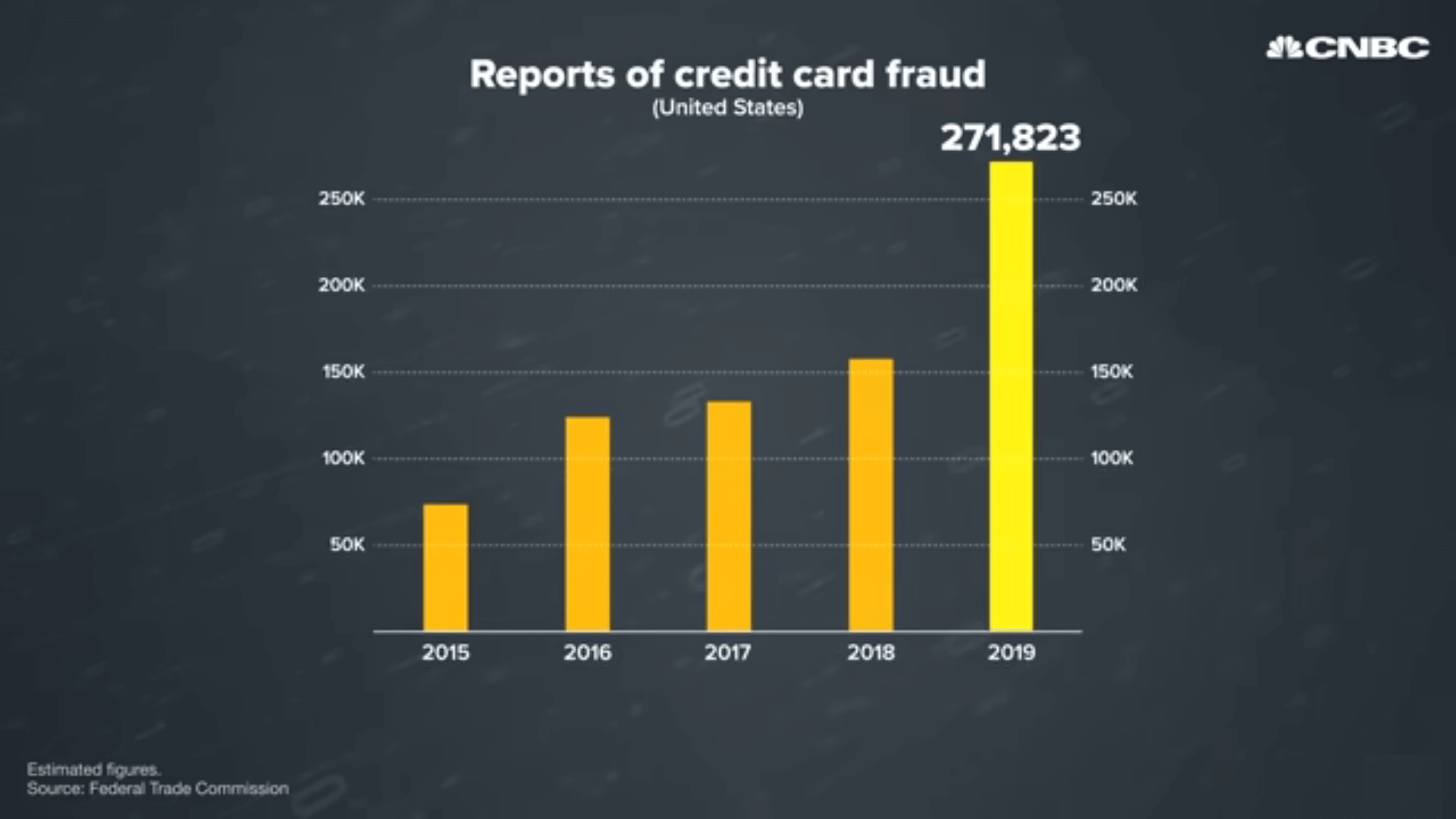

According to data from CNBC and US Federal Trade Commission, a total of 271,823 credit card fraud cases were reported in 2019, more than doubling the total in 2017.

One of the major reasons is traditional credit cards are less secure compared to other means of payment. Thus, a crucial advantage that sets crypto credit cards apart from normal credit cards is security.

If you already understand how crypto credit cards work, let’s investigate why crypto cards represent a significant breakthrough for safe and convenient payment transactions.

First things first

A few things to clear up. The so-called cryptocurrency credit cards from traditional banks are not actually crypto credit cards because they do not allow you to spend in crypto and they use traditional plastic cards.

A true crypto credit card uses a blockchain wallet as the card. This means your wallet address is your crypto card number. So, you don’t actually carry a physical card but instead, carry your wallet app on your smartphone or install it on your PC or web browser. You could have a plastic card in the future albeit a digital wallet in a form of a card.

1. Every crypto card transaction is digitally signed

One significant factor that makes crypto credit cards more secure than traditional credit cards is digital signature. The process of signing digitally involves converting a text into a gibberish version and verifying that the text was signed by a person, or in this case a wallet address. This is reminiscent of how you sign on a paper receipt when you pay using your plastic credit card.

When you are making a transaction with your crypto card via your blockchain wallet like MetaMask or Trust Wallet, the transaction details are signed using the private key of your wallet. The digital signature and your wallet address are sent to the card processing network to verify that it was your wallet address — which is also your card number – that actually signed the transaction. This proves that you were the one who performed the payment.

This ultimately means even if someone knows your crypto credit card details, they can’t forge it and defraud you by making unauthorized transactions. Why? Because they don’t have your private key. This is why you’re always reminded not to share your private key with anyone.

In contrast, traditional credit cards store information using magnetic stripes or chips which contain all the necessary credit card data (your name, card number, expiry date, CVV/CVC code) for someone to spend your card without your consent.

2. Kiss goodbye to your lost cards

One of the biggest problems many people face with standard credit cards is the risk of losing their physical cards.

Not only is losing the card a nightmare because it lets someone illegally use our card, but it can also be very stressful and time-consuming when trying to cancel the card and request a new one.

However, since crypto credit cards are virtual cards, a lost card can be retrieved easily, as long as you don’t share with anyone your private key. Knowing your crypto card is your crypto wallet, you only need to reinstall the same wallet app or software and restore your digital wallet by entering your previous private key.

The same would also apply to physical crypto cards in the future because these cards do not hold private keys.

Thus, if you ever lose your phone or computer where your crypto credit card is stored, you can rest assured that your card is safe and secure, assuming you did not keep your private key inside them.

All you have to do is access your digital wallet from another device, and your crypto credit card will be right there waiting for you.

3. Spend anonymously

If you are one of the many people that would love to make purchases and spend without revealing your identity, then a crypto credit card is definitely for you.

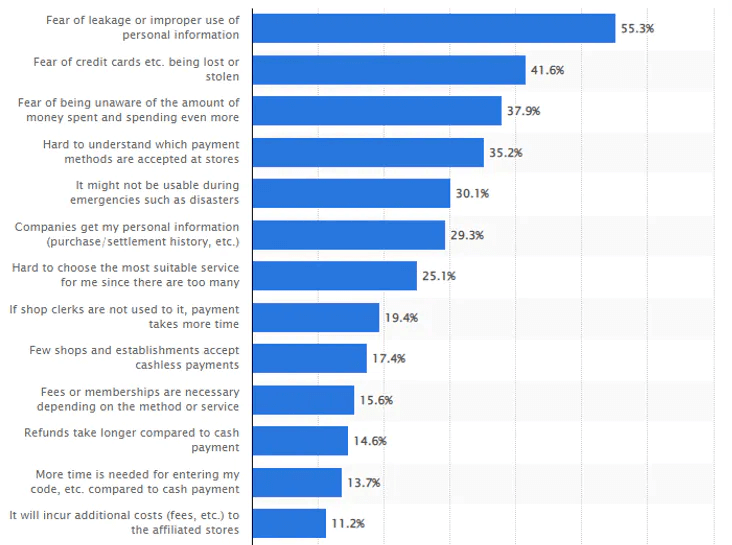

According to Statista, privacy concerns and identity fraud are the main reason why Japanese prefer cash to plastic. Traditional credit cards require online merchants to submit your personal details when processing a transaction. These retailers have all the opportunities to retain all your sensitive information including your card details. This elevates the chance of credit card and even identity fraud.

A worse-case scenario would be a data breach on the merchant’s side where your data falls into the hands of hackers.

This fear doesn’t have to spread to crypto credit cards. You are not required to submit your private info such as your name, address, and phone number to our merchants when spending online or offline.

They only require your wallet address, which is your card number. But then, there’s nothing they could do with that number as long that you do not hand over your private key.

With a cryptocurrency credit card, you are in total control over your personal information and are protected from myriad types of fraud and data breaches.

4. Non-custodial feature

Traditional credit cards rely on a custodial model, where banks, payment processors as well as merchants hold your card information. This is akin to letting them hold your credit card “password.” A breach in one of their systems could cause havoc as someone could steal your card data and perform unauthorized transactions.

Crypto credit cards, on the other hand, offer a non-custodial solution because only you shall hold your card password – which is your wallet’s private key. Thus, there’s no risk of payment fraud because no one can make illegal transactions without your consent.

With the non-custodial solution that crypto card technology offers, you can maintain complete control over your card which significantly reduces the risk of theft or fraud.

Takeaway

Crypto credit cards provide a degree of safety that over-surpasses traditional credit cards. With the surging popularity of digital currency and the increased demand for protected payment options, it’s unsurprising that many individuals are now opting for crypto credit cards as their preferred payment method.

Therefore, if you aim to spend securely, acquiring a crypto credit card would be a wise decision today.